For the first time, a delegation from the Institute for Global Security & Defense Affairs (IGSDA) participated in the Seoul International Aerospace & Defense Exhibition (ADEX), one of the most prominent and largest defense exhibitions held in the Republic of Korea. The event took place in the Korean capital, Seoul, during the period October 19–23, 2023.

The opening day featured aerial demonstrations at Seoul Air Base, showcasing the full spectrum of aircraft operated by the Republic of Korea Air Force, along with several next-generation platforms still under testing, such as the KF-21 fighter jet. The event also included a performance by the renowned Black Eagles aerobatic team.

Later that evening, KAI (Korea Aerospace Industries) hosted the “Eagles Night” event, attended by all domestic and international delegations. Prominent participating countries included the Philippines, Indonesia, Iraq, Egypt, Algeria, Jordan, Poland, Mexico, and Malaysia. During the event, KAI presented its latest defense products and technological solutions, while honoring its international guests.

From the second day until the exhibition’s conclusion, activities and displays were held at the KINTEX Convention Center, featuring 1,350 companies from 65 countries. Among them were all major South Korean defense corporations, notably KAI, Hyundai Rotem, LIG Nex1, Hanwha Group, KIA, LG, and Korea Air.

Through our visits and scheduled meetings with executives from South Korea’s leading defense companies, as well as with the Chairman of the Exhibition Organizing Committee, several key observations were made:

- South Korea’s defense industry has developed products and services that now cover almost all categories of primary and secondary weapons and munitions.

- It is evident that South Korean companies have greatly benefited from their long-term partnerships with the United States, as their current industrial capabilities were built upon joint manufacturing contracts with U.S. firms dating back to the 1980s.

- There exists a remarkably open corporate culture, welcoming constructive criticism and suggestions from employees at all levels. This was particularly noticeable during our technical discussions on specific weapon systems and displayed technologies.

- There is a clear strategic orientation among South Korean companies toward international expansion, emphasizing joint manufacturing and technology transfer opportunities.

- A degree of similarity was observed between some newly developed South Korean systems and their Israeli counterparts, likely stemming from bilateral cooperation over previous years.

For clarification, this can be illustrated through the following example:

- Active Defense System:

- SOJ electronic warfare aircraft:

The major South Korean defense companies presented integrated armament solutions, reflecting the country’s progress toward developing a comprehensive national air and missile defense network, in addition to a complete range of aircraft types across all specializations for the Air Force, and fully developed capabilities for the Army and Navy.

The most notable technical observations and discussions held with company representatives can be summarized as follows:

- The KF-21 fighter remains in the testing phase for weapon integration, with several new-generation missiles designed for the aircraft still under development—some in prototype stages and others still in the research phase.

- Despite the general secrecy maintained by South Korean firms regarding the specifications of their weapons and systems, our discussions yielded the following insights:

- The maximum detection range of the AESA radar developed by Hanwha Systems for the KF-21 is 200 km, with the ability to engage three targets simultaneously.

- The LRAAM (Long-Range Air-to-Air Missile) has an effective range of 200 km.

- The SRAAM (Short-Range Air-to-Air Missile) has a maximum range of 30 km and lacks post-launch guidance. Its infrared seeker provides a targeting cone of approximately 90 degrees, and the missile is not integrated with the pilot’s helmet-mounted sight.

- The KALCM (Korean Air-Launched Cruise Missile) has a range of up to 500 km, designed for internal carriage within the KF-21 airframe.

- Hanwha has developed an active protection system (APS) against anti-tank projectiles, analogous to the Israeli Trophy system. This Korean APS integrates electro-optical and radar detection and can intercept all types of incoming projectiles, including tank shells. However, its drawbacks include an unarmored radar module, limited ready-to-use countermeasure rounds (two per launcher), and the requirement for manual reloading once the rounds are expended.

Summary of Recommendations Presented by the IGSDA Team to South Korean Companies:

- Maintain South Korea’s policy of neutrality, supporting peace and stability in conflict regions. Civil wars and combat against non-state armed groups often conflict with South Korea’s ethical principles in arms export policy.

- Avoid direct competition with China; instead, pursue complementary cooperation in the Middle Eastern defense market, especially in Arab countries, where China enjoys considerable popularity and strategic acceptance.

- Refrain from publicly criticizing or targeting North Korea’s reputation in Arab states, as this may adversely affect South Korea’s public image in the region. South Korea should instead emphasize its technical excellence and professional standards.

- The South Korean government should facilitate financial mechanisms and export credit arrangements to support the expansion of Korean weapon systems within foreign armed forces, both in terms of quantity and diversity.

- Deepen joint production with Middle Eastern countries possessing existing defense industrial bases. Such cooperation would reduce unit production costs, increase output rates, and allow Korean companies to scale up production without injecting new capital to expand manufacturing lines.

- Launch a joint industrial defense program between South Korea and Middle Eastern partners to consolidate regional buyers with similar weapon requirements. This would lower acquisition costs and enable Korean firms to strengthen partnerships, paving the way for additional arms sales.

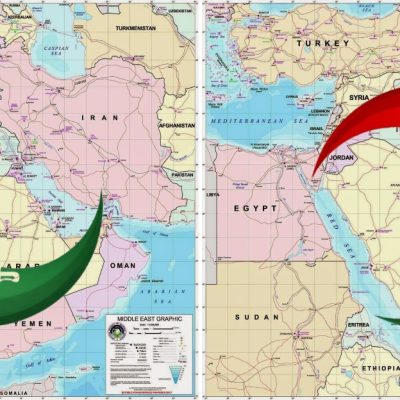

- Diversify military partnerships and weapon sources, a policy currently pursued by Egypt and the Gulf states, while enhancing joint training exercises with these countries. However, caution is advised when engaging with Algeria and Morocco due to their complex regional dynamics.

- Accelerate participation in defense exhibitions and military activities, particularly in regions where Turkey is attempting to fill the void left by Russian defense industries—such as in Syria and Egypt.

- In Arab arms markets, it is crucial to consider political relations with importing states, minimize export restrictions, ensure quality, speed up delivery timelines, and maintain cost control.

- South Korea should seek to position itself as a viable alternative within the concept of a regional integrated air and missile defense network. At present, only the United States (partially), Israel, and Russia possess systems capable of such comprehensive functionality, yet each faces regional limitations. This presents a strategic opportunity for South Korean defense companies to assume a pivotal role in this emerging defense architecture.

Report Prepared by:

Ahmed Adel Abdel-Aal

Researcher in Military Affairs, Institute for Global Security & Defense Affairs (IGSDA)

Ph.D. Researcher in Political and Strategic Sciences – Military Academy for Advanced and Strategic Studies